Many people looked for financial help during the Covid pandemic. Robert Kiyosaki’s “Rich Dad Poor Dad” was a big help. It taught new ways to think about money and making wealth.

The book teaches by comparing two dads’ money views. This helps readers understand how to be financially free. We’ll look at the book’s psychology and how it can help you succeed financially.

Key Takeaways

- Understanding the financial mindset is key to financial freedom.

- “Rich Dad Poor Dad” teaches valuable money lessons.

- Mindset coaching helps change money habits.

- Robert Kiyosaki’s stories teach wealth lessons.

- The right money mindset leads to success.

Want to start your financial freedom journey? Try Amazon Audible for free and listen to “Rich Dad Poor Dad”: AMAZON

The Rich Dad Poor Dad Psychology Framework

Robert Kiyosaki introduced the Rich Dad Poor Dad framework. It focuses on two mindsets that guide our money choices. It also questions the usual ways we think about money and learning about it.

The Two Contrasting Mindsets Explained

The “poor dad” way is about just getting by. It’s about earning a salary and being careful with money. On the other hand, the “rich dad” approach is about growing wealth. It teaches the value of knowing about money and taking smart risks.

How Mental Models Shape Financial Decisions

Mental models play a big role in our money choices, as shown in Rich Dad Poor Dad. The rich dad way teaches us to think outside the box. It sees problems as chances to learn and grow financially.

Choosing the rich dad mindset helps us make better money choices. It promotes learning and growing personally and financially.

Key Psychological Principles for Financial Success

Getting rich needs knowing how our minds work with money. The rich and poor see money differently. It’s key to know these differences.

One big idea is knowing assets from liabilities. Robert Kiyosaki says, “The rich buy assets, not liabilities.” This change in thinking is key to getting rich.

Assets vs. Liabilities: Rewiring Your Brain

The rich buy things that make money, like real estate or stocks. The poor and middle class buy things that cost a lot, like fancy cars. To get rich, focus on buying things that make money.

Overcoming Fear and Building Risk Tolerance

Fear stops many from getting rich. The rich and poor see fear differently. The rich take smart risks and learn from mistakes. Kiyosaki says, “Financial literacy comes from experience.”

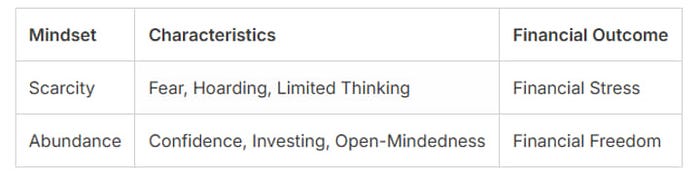

Developing an Abundance vs. Scarcity Mindset

Having an abundance mindset is key to getting rich. It means believing there’s enough for everyone. This mindset makes you want to start businesses, invest, and make smart money choices.

By using these mind tricks, you can do better with money. It’s all about how you think about money and wealth.

“The more you learn, the more you earn.”

Robert Kiyosaki

How to Apply These Psychological Principles Daily

Using the ideas from Rich Dad Poor Dad can really help your financial literacy. To get better with money, you need to use these ideas every day.

Creating New Financial Thought Patterns

To get better with money, you must change how you think about it. Start by replacing bad thoughts with good ones. Think about making money and being free from money worries.

Practical Exercises to Strengthen Your Wealth Mindset

Doing practical things can make you think more positively about money. For example, write down three things you’re thankful for every day. Or, imagine your money goals to keep a positive mind.

Immersive Learning Through Audiobooks

Listening to audiobooks is a great way to learn from Rich Dad Poor Dad. It makes the ideas easier to understand and use in your life.

Get Your Free Amazon Audible Trial of Rich Dad Poor Dad

Start listening to Rich Dad Poor Dad today with a free trial of Amazon Audible. Just click this link to begin: Get Free Trial

Conclusion: Your Journey to Financial Intelligence

Learning from “Rich Dad Poor Dad” can change your life. It helps you understand how to think about money. This way, you can start to make more money.

It’s important to think like an entrepreneur to control your money. You need to know what’s an asset and what’s a liability. You also have to be brave and willing to take risks. Using these ideas every day can help you succeed financially.

Robert Kiyosaki’s story shows how important your views on money are. Your experiences and where you are shape your money thoughts. By learning more about money and being active, you can get smarter about money. This will help you reach your financial goals.

FAQ

What is the Rich Dad Poor Dad psychology framework?

The Rich Dad Poor Dad framework talks about two mindsets. The “poor dad” focuses on just getting by. The “rich dad” aims to grow wealth.

How can I develop an abundance mindset?

To have an abundance mindset, look for chances and be open to new things. Believe there’s enough wealth for everyone. This helps you make smart money choices.

What is the difference between assets and liabilities?

Assets make money, like real estate or stocks. Liabilities cost money, like credit card debt. Rich Dad says focus on assets.

How can I overcome fear and build risk tolerance?

Learn about money, start small, and take on more risks slowly. This builds your confidence and helps you succeed financially.

What are some practical exercises to strengthen my wealth mindset?

Set money goals, track spending, and say positive things to yourself. Listen to Rich Dad Poor Dad on Amazon Audible for learning.

How can I apply the psychological principles outlined in Rich Dad Poor Dad to my daily life?

Change your money thoughts and actions by effort. Create new money habits, practice wealth exercises, and learn through audiobooks.

What is the importance of financial literacy in achieving financial freedom?

Knowing about money is key to freedom. It lets you make smart choices. Understanding assets and liabilities helps you control your money.

How can I cultivate an entrepreneurial mindset?

Be ready for new chances, take smart risks, and go after your money goals. This mindset leads to freedom and success.

0 Comments